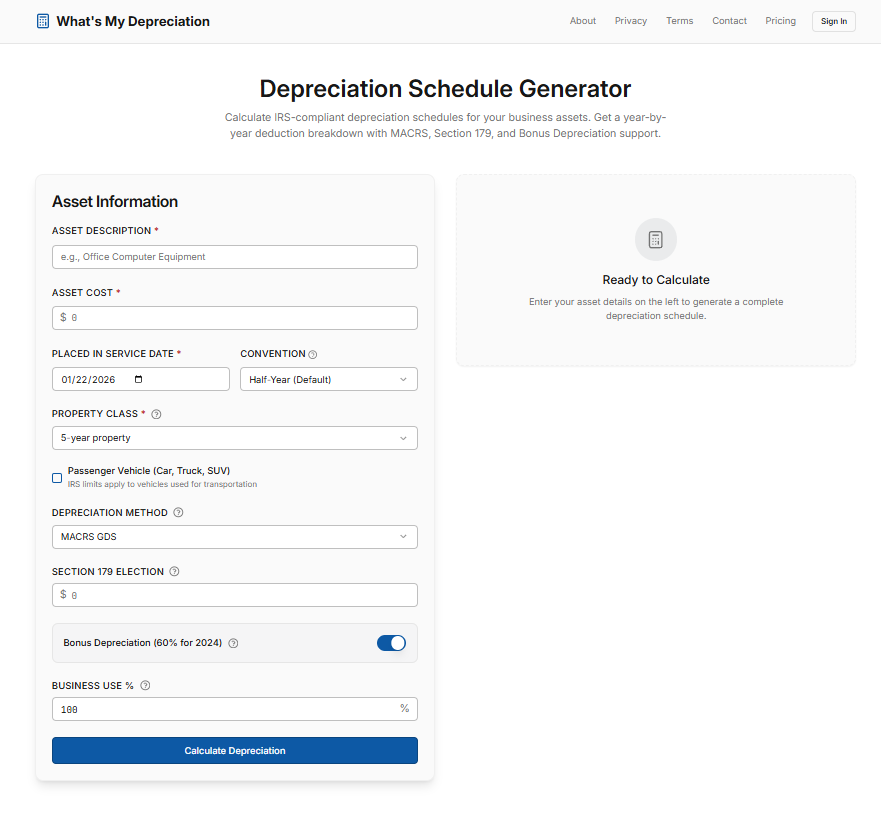

What's My Depreciation

Free IRS-compliant depreciation schedules in seconds

What's My Depreciation – Free IRS-compliant depreciation schedules in seconds

Summary: What's My Depreciation generates accurate IRS-compliant depreciation schedules for business assets, supporting all MACRS property classes, Section 179 deductions, and Bonus Depreciation for 2025. It handles luxury vehicle caps and mid-quarter conventions, exporting results to PDF or CSV.

What it does

The tool calculates depreciation schedules using IRS rules, including MACRS classes (3 to 39 years), Section 179 limits, and 40% Bonus Depreciation for 2025. It supports luxury vehicle caps, mid-quarter conventions, and exports schedules in PDF or CSV formats.

Who it's for

Designed for small business owners, freelancers, and accountants needing quick, accurate depreciation calculations without costly software.

Why it matters

It simplifies complex IRS depreciation rules, providing precise schedules that avoid errors common in oversimplified calculators or expensive software.