SettleRisk

Resolution risk scoring API for prediction markets

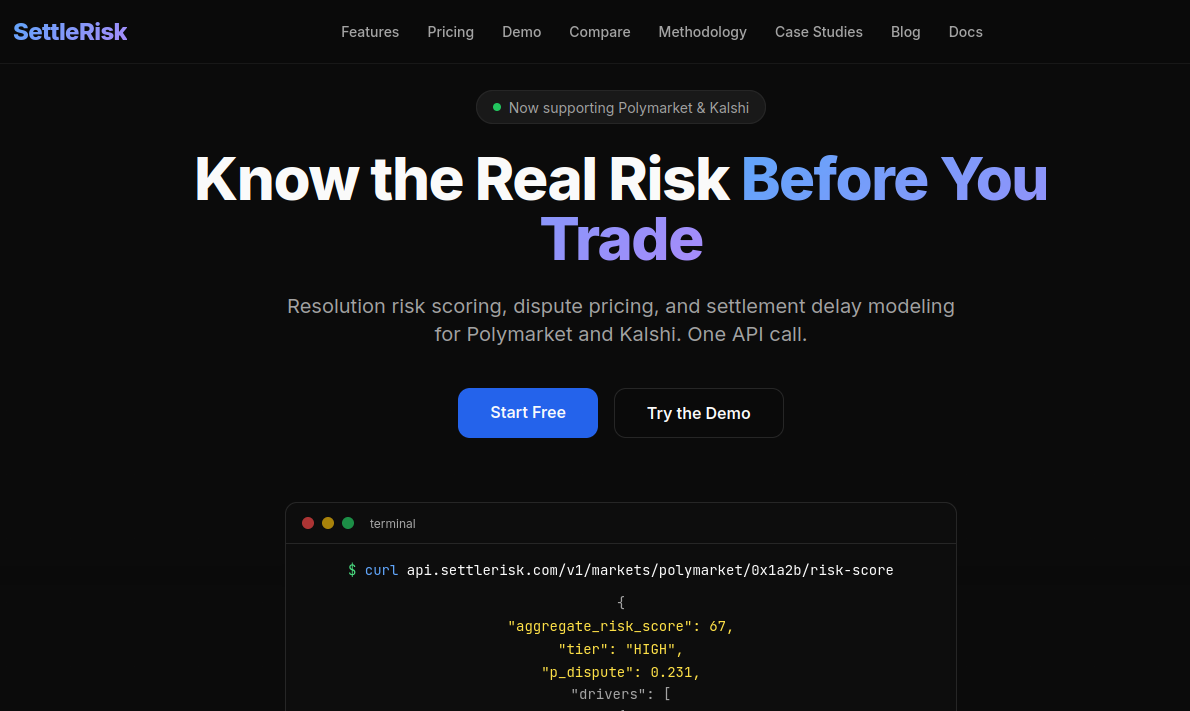

SettleRisk – Resolution risk scoring API for prediction markets

Summary: SettleRisk provides a 0–100 risk score for prediction market contracts, estimating the likelihood of disputes, delays, or frozen capital. It delivers explainable risk drivers, dispute-adjusted pricing, and settlement delay estimates via a single API call, supporting Polymarket and Kalshi.

What it does

SettleRisk quantifies dispute risk using a 15-driver taxonomy covering factors like ambiguous wording and oracle dependency. It outputs deterministic risk scores, risk premiums, capital lockup costs, and fair spreads with sub-5ms latency, designed for integration into trading pipelines.

Who it's for

It targets prediction market traders and market makers who need real-time risk assessment to manage capital and execution strategies.

Why it matters

It addresses the problem of capital being locked in disputes, which can last weeks and cause significant losses due to ambiguous contract terms and contested resolutions.