Portfolio Tax Simulator

Calculate real portfolio returns after taxes

Portfolio Tax Simulator – Calculate real portfolio returns after taxes

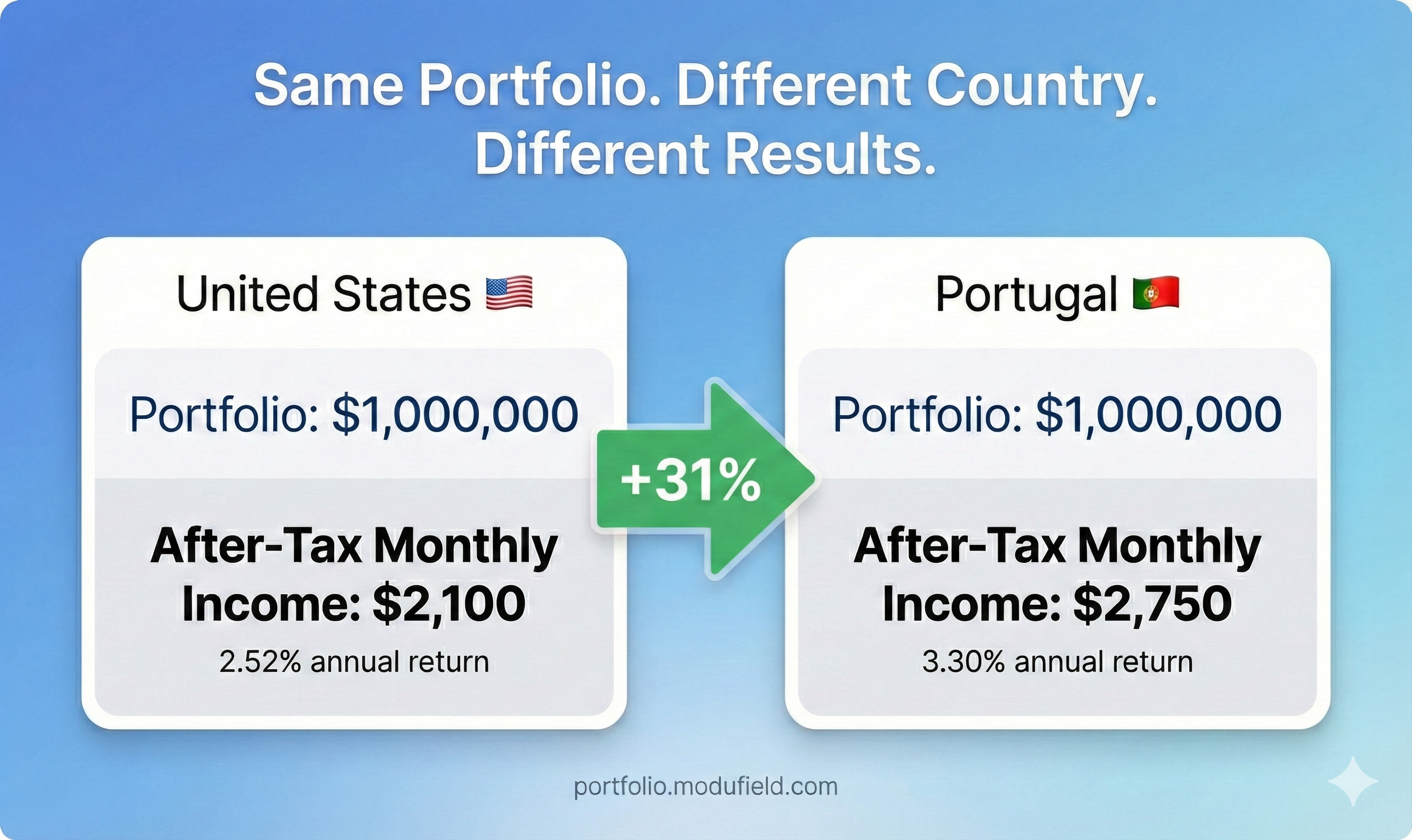

Summary: Portfolio Tax Simulator calculates after-tax returns for investment portfolios across multiple countries and currencies, enabling users to compare tax impacts on US ETFs, UCITS funds, and bonds. It supports real-time tax calculations for over six countries and projects after-tax income without requiring signup.

What it does

The tool tests portfolios under different tax scenarios, allowing side-by-side comparisons of tax effects on returns in various countries and currencies. It covers tax rules for at least six countries including Portugal, Greece, the US, and Israel.

Who it's for

It is designed for investors, expats, and individuals planning relocation or portfolio tax optimization across multiple jurisdictions.

Why it matters

It solves the challenge of understanding how diverse tax regulations affect real portfolio returns, aiding in informed investment and relocation decisions.