OASIS: Quantum-Classical Finance Hybrid

20 years of market data analyzed in 20 mins on a laptop

OASIS: Quantum-Classical Finance Hybrid – 20 years of market data analyzed in 20 minutes on a laptop

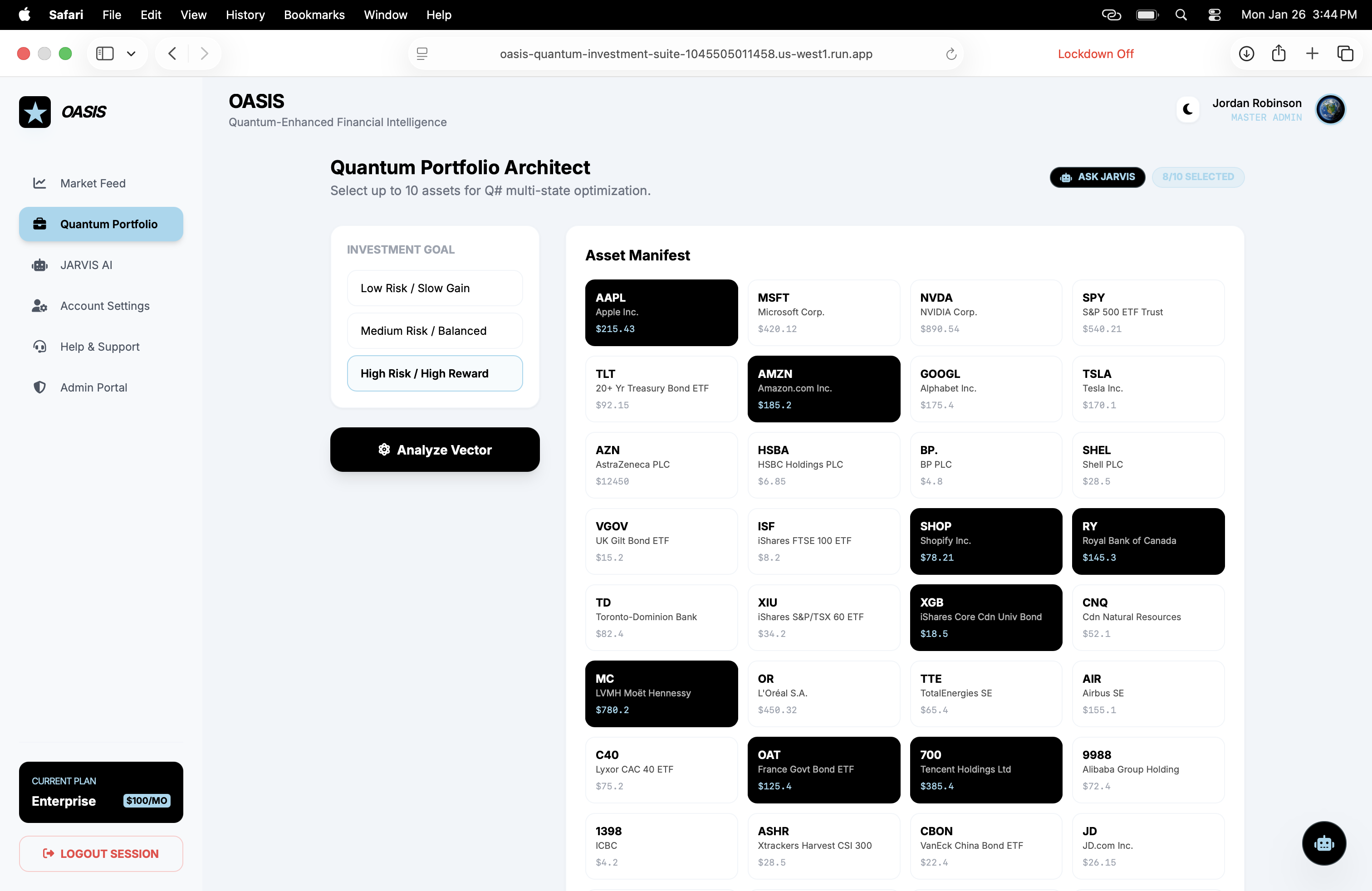

Summary: OASIS combines Q# Grover’s Algorithm with a proprietary large language model to accelerate financial simulations, enabling analysis of over 20 years of market data for 50 stocks across six global markets in under 20 minutes on consumer hardware.

What it does

It uses quantum-inspired optimization and classical computing to bypass traditional computational bottlenecks, running complex market simulations locally without relying on cloud servers or opaque AI models.

Who it's for

OASIS targets retail investors seeking advanced market analysis tools without requiring specialized hardware or institutional resources.

Why it matters

It democratizes access to high-frequency trading insights by enabling fast, local analysis of extensive historical market data that was previously accessible only to institutions with expensive infrastructure.