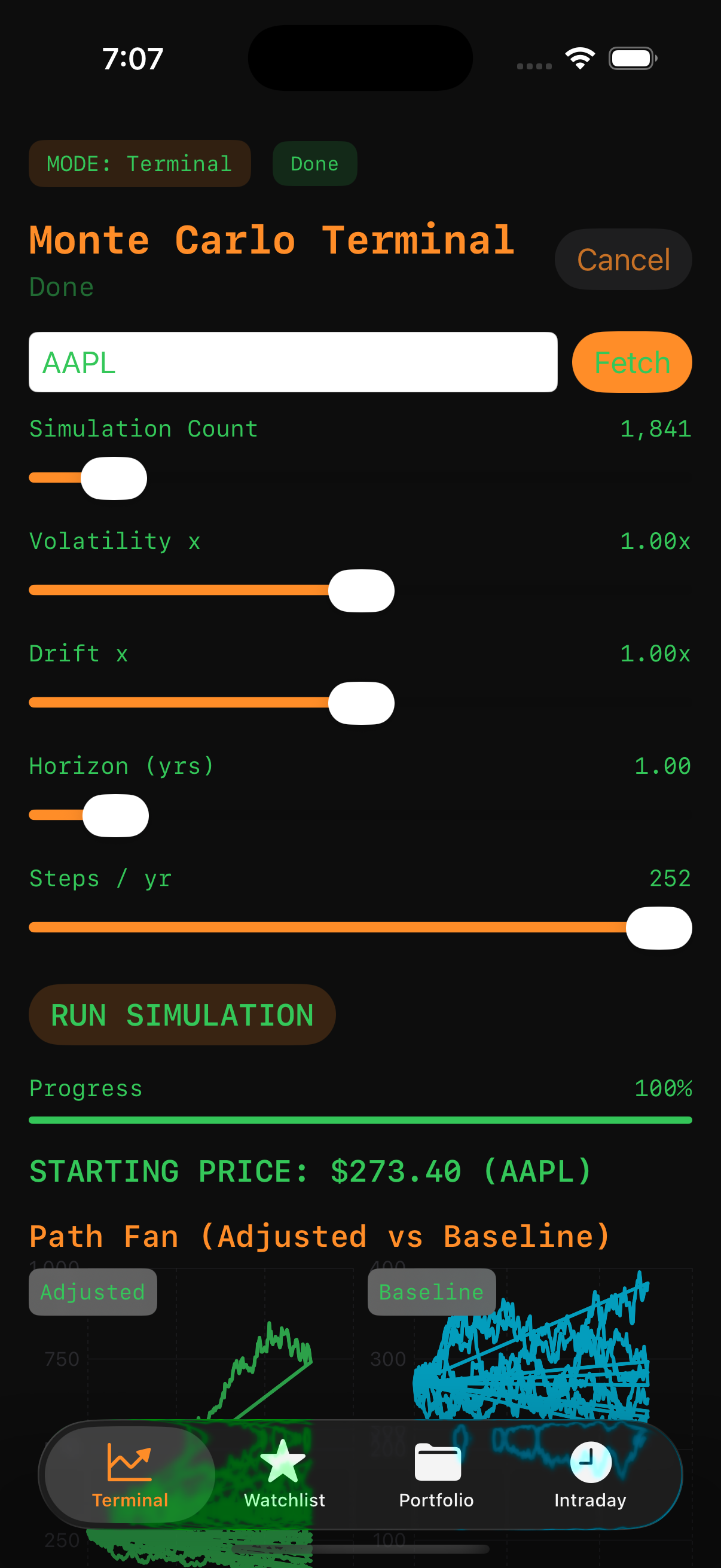

Market Analysis Simulator

Bloomberg-style Monte Carlo simulator for iPhone

Market Analysis Simulator – Institutional-grade Monte Carlo risk modeling on iPhone

Summary: Market Analysis Simulator delivers Bloomberg-style portfolio risk modeling on iPhone by running Monte Carlo simulations with up to 1 million paths and correlation modeling. It enables testing portfolios against historical crashes to reveal diversification breakdowns during market stress.

What it does

The app performs Monte Carlo simulations on stocks or multi-asset portfolios, incorporating asset correlation via Cholesky decomposition. It also backtests portfolios against historical crashes like 2008 and 2020 to assess risk under extreme conditions.

Who it's for

It targets users interested in professional risk analysis, including finance enthusiasts, quantitative traders, and anyone curious about institutional portfolio modeling.

Why it matters

It provides tangible insights into portfolio risk by simulating market stress scenarios and revealing how diversification can fail during crises.