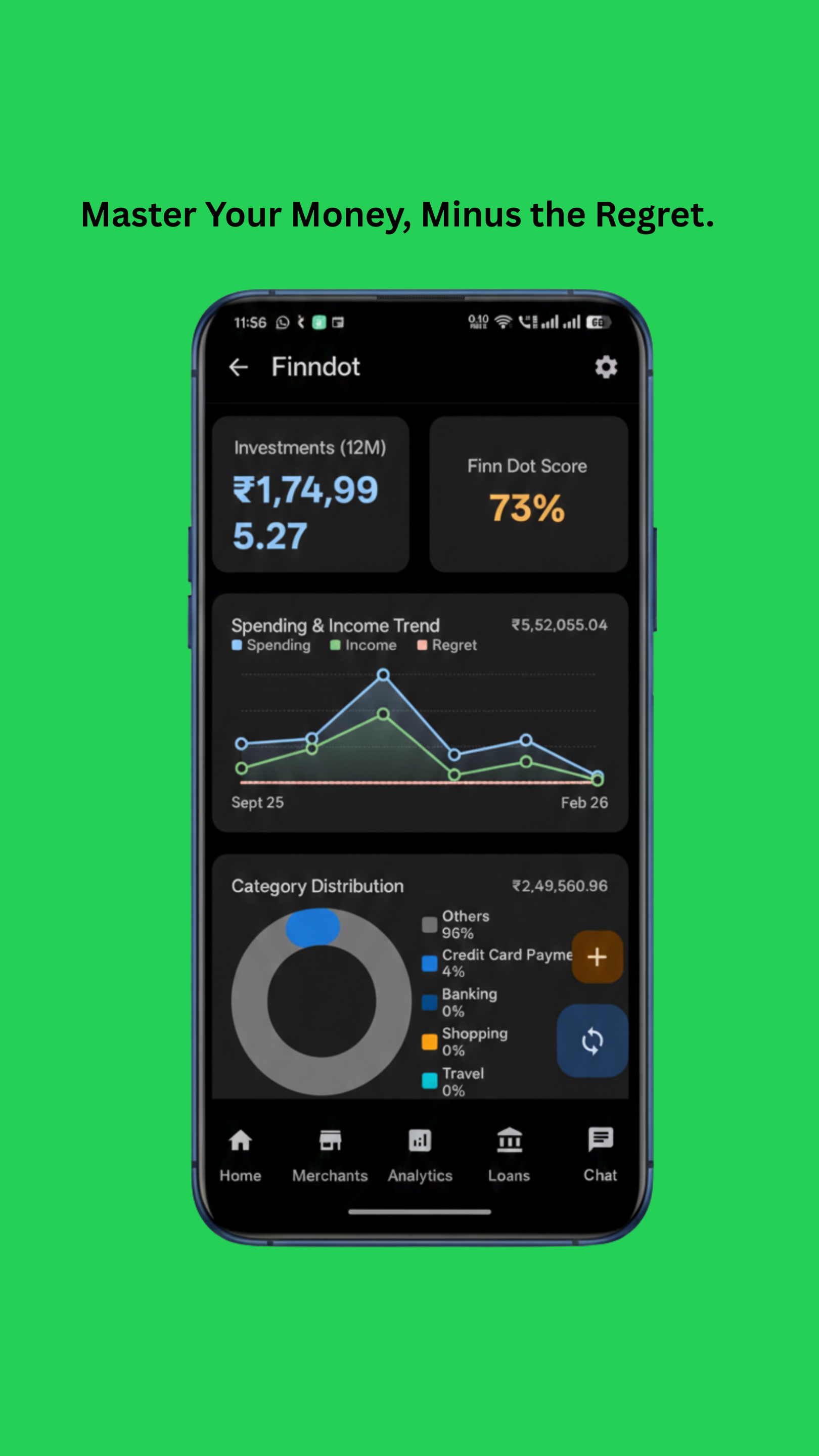

Finndot

AI Financial Assistant for Bharat.

Finndot – AI Financial Assistant for Bharat’s Gig Economy

Summary: Finndot uses AI-driven behavioral profiling and the RBI-regulated Account Aggregator framework to create a real-time Trust Score for gig workers and freelancers in India. It converts cash flow data into financial visibility, enabling users without traditional credit history to access fairer credit options.

What it does

Finndot builds alternative credit scores by analyzing income and spending patterns through AI and secure data aggregation. It identifies investable surplus and prepares users to become bank-ready while maintaining strict data privacy with consent-based, encrypted access.

Who it's for

It targets gig workers, freelancers, and new earners in India who lack conventional credit history or salaried income documentation.

Why it matters

Finndot addresses the financial invisibility of non-traditional earners by providing a trustworthy credit profile based on actual cash flow and behavior, enabling access to credit and financial services.