Fidr

Build low-risk portfolios by defining how much you can lose

Fidr – Build portfolios by defining maximum acceptable loss

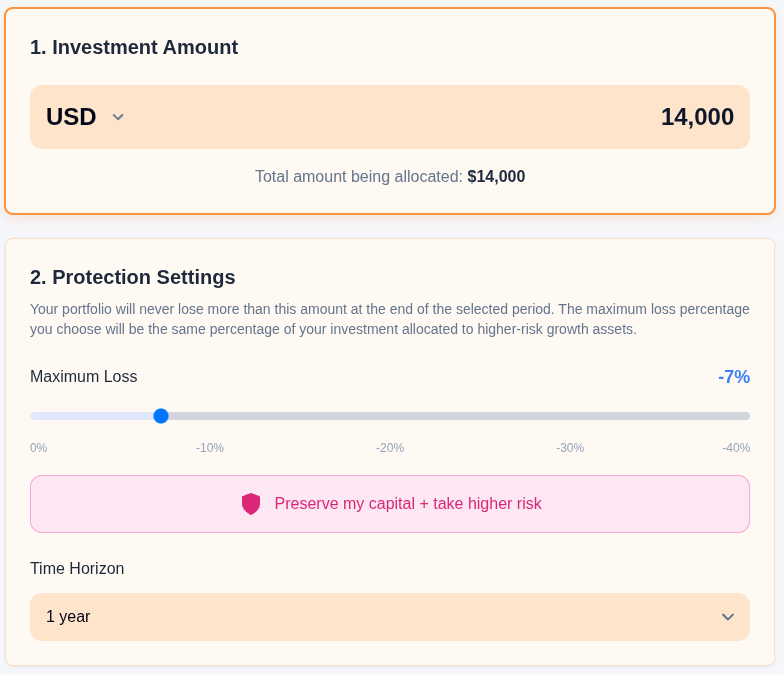

Summary: Fidr helps investors create low-risk portfolios by setting a maximum acceptable loss and allocating capital accordingly. It uses current bond yield curves to determine safe asset allocation and balances risk without exceeding loss limits, focusing on capital preservation through scenario-based analysis.

What it does

Fidr calculates how much capital to allocate to safe and risky assets based on user-defined investment amount, time horizon, and loss tolerance, using bond yield curves. It prioritizes downside risk over expected returns.

Who it's for

Investors seeking portfolio allocations driven by loss limits rather than return targets.

Why it matters

It addresses the need for portfolio tools focused on capital preservation by managing risk through defined loss constraints.