DealSpark

M&A deal management for SMB Buyers and Search Entrepreneurs

DealSpark – M&A deal management for SMB Buyers and Search Entrepreneurs

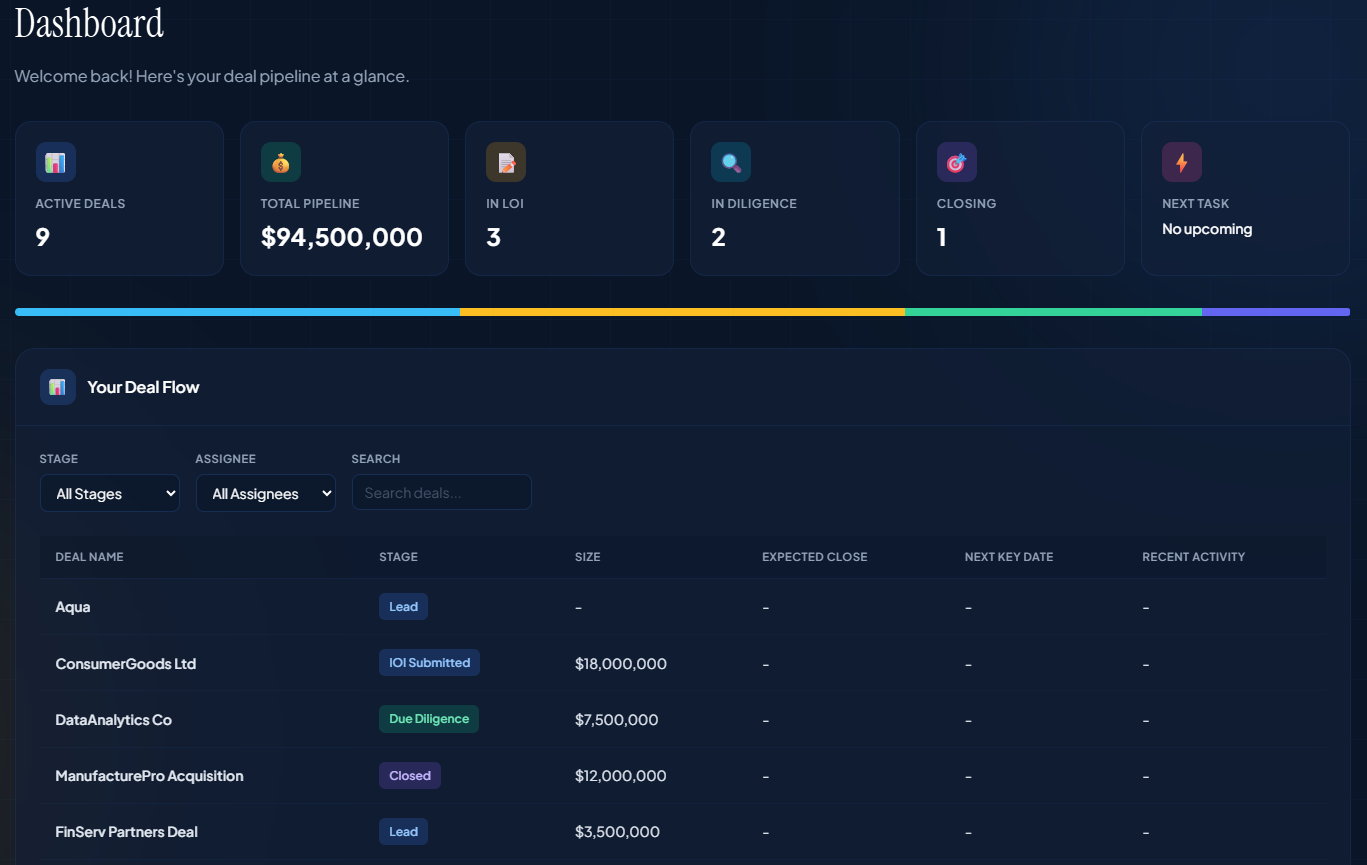

Summary: DealSpark centralizes M&A workflows by providing a visual deal pipeline, AI-powered financial analysis, LOI generation, SBA loan calculation, and due diligence management within a single platform. It supports deal tracking, financial review, and document generation to streamline acquisition processes.

What it does

DealSpark offers Kanban-style deal tracking, AI-suggested addbacks for uploaded P&Ls, automated LOI and CIM generation, SBA loan analysis, and diligence tracking with Gantt charts and checklists.

Who it's for

It is designed for search fund operators, independent sponsors, private equity associates, corporate development teams, and anyone involved in buying businesses.

Why it matters

It replaces scattered spreadsheets and documents by consolidating deal management tools, reducing chaos and improving organization throughout the M&A process.