Coin Cat

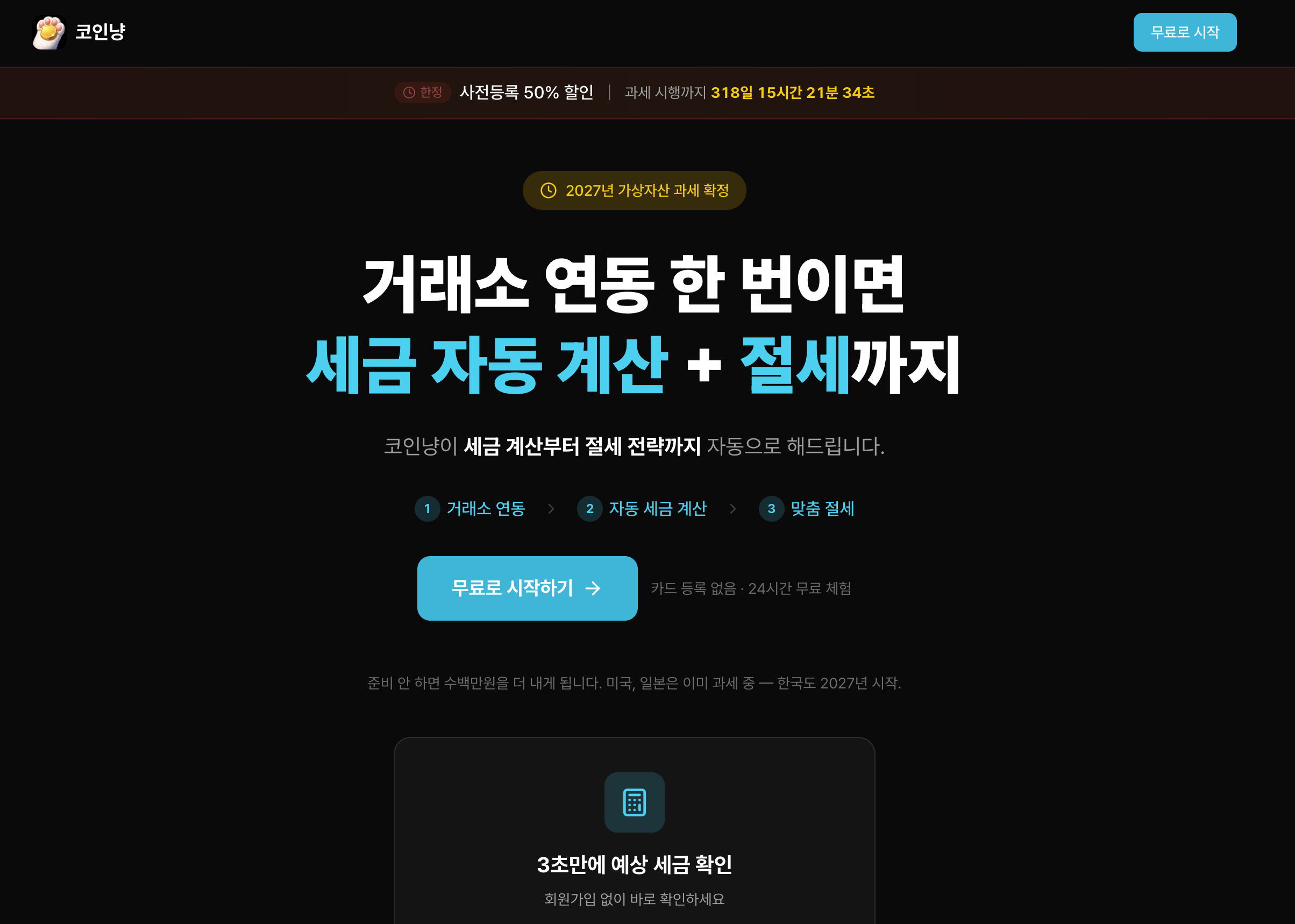

TurboTax for Korean crypto investors

Coin Cat – Crypto tax calculation and portfolio tracking for Korean investors

Summary: Coin Cat syncs trades from major Korean exchanges, calculates capital gains using FIFO, and provides tax-loss harvesting alerts to help investors prepare for Korea's 22% crypto tax starting in 2027. It offers real-time portfolio tracking and exportable reports for tax filing.

What it does

Coin Cat connects to Korean exchanges via read-only APIs to aggregate transactions, calculates tax liabilities based on FIFO cost basis, and alerts users to potential tax savings. It also tracks portfolios in real time and exports reports for filing.

Who it's for

It is designed for Korean crypto investors managing multiple exchange accounts who need accurate tax calculations and portfolio oversight.

Why it matters

It simplifies complex tax calculations across multiple exchanges, reducing errors and helping investors comply with Korea’s upcoming crypto tax regulations.